Summary

Why does it take 2 weeks for a commercial banking client to open up an account with J.P. Morgan? It is mostly because that the internal manual process of opening a commercial account has been around for more than decades.

In this project, I led product and design development on building the best prosumer experience for bankers. With a focus on the priority of providing the costumer a better experience when opening account, this brand new digitized experience shortened the account opening process from 2 weeks to 1 day. Reduced the amount of tools used from 20+ to 1.

Deliverable

Service design (Service blueprint)

cross organization user experience design

usability testing

My roles

Lead product designer

Drive design deliverable and cross organization product strategy

Lead stakeholder workshop

User research

Timeline

10 weeks

Intro

A commercial account is just like our personal checking account, but for a company to conduct their daily business.

After conducting 20+ researches, partnering with researchers, I realized that this 2 weeks process is extremely manual and requires 20+ tools with employees across front, middle and back office of the bank.

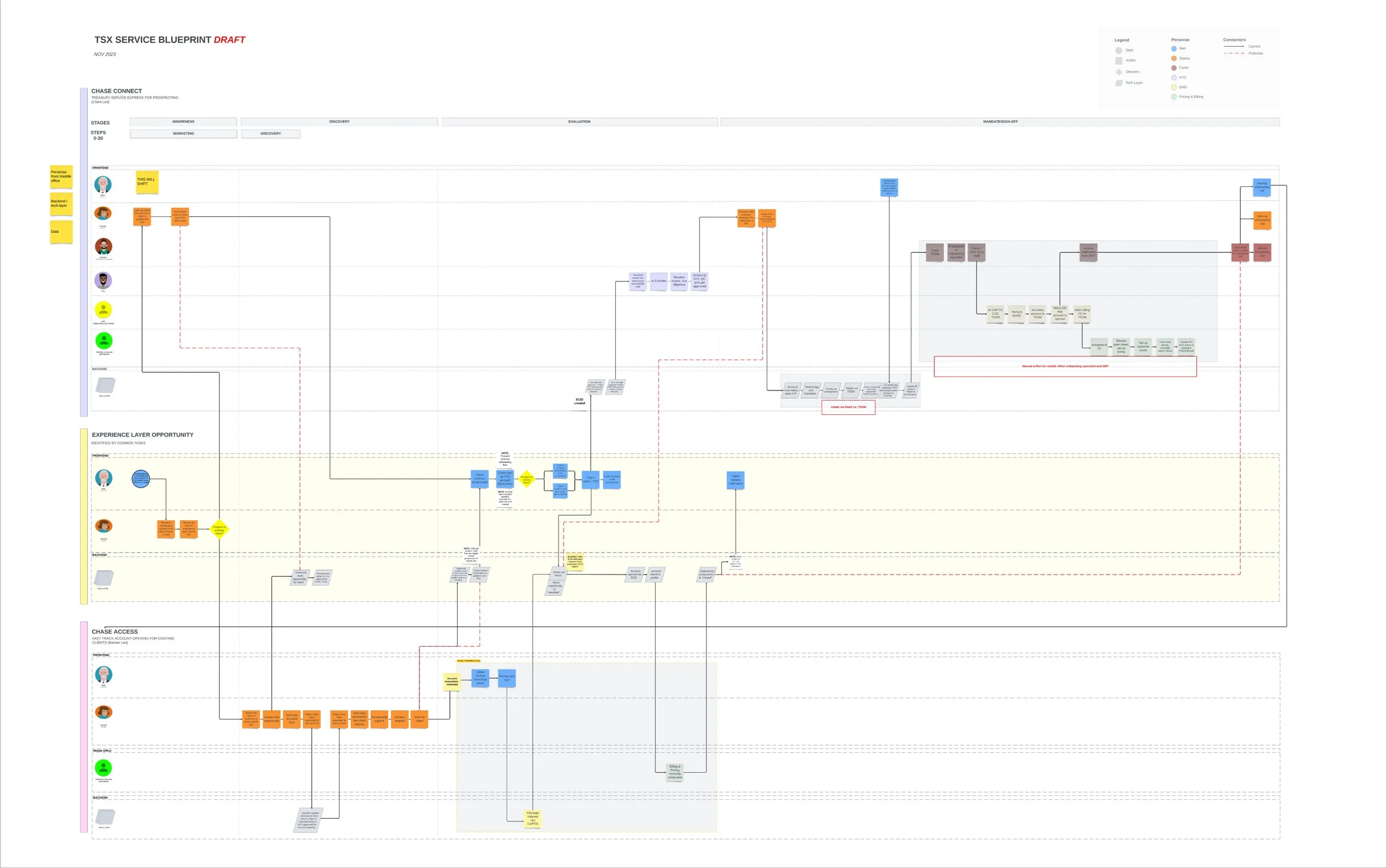

This is a high level flow of current process for bankers opening an account for a commercial client. As the connection line suggest, it is a manual process with back and forth communication. Each step has its pain points that are frequently pointed out by employees and data.

This process is a clear demonstration of Conway’s law, where any organization that designs a system will produce a design whose structure is a copy of the organization's communication structure. How do we better facilitate this communication so that we deliver the best experience to our client?

Service design - service blueprint

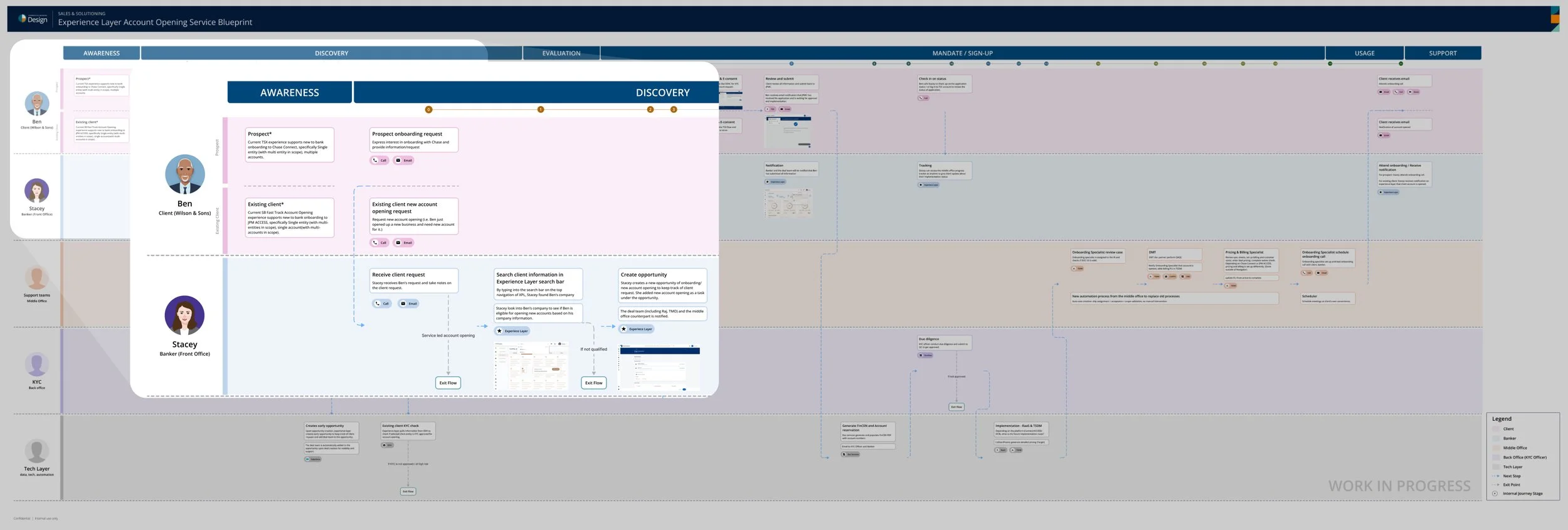

Simple as opening account, it requires communication across everywhere from the bank. With my domain knowledge in banking and the underlaying tech stack, I created a service blueprint to capture all current and propose future experience for banker opening account. It captures the interactions between client, banker, support team from middle office, KYC (know your client) team, tech layer (api, database).

As I connect with stakeholders across teams, I developed a better understanding of their roadmap and compiled all tech stack that is being leveraged in the process. From a messy diagram of merging experience across teams, I generated the target state experience service blueprint on the bottom.

I leveraged this service blueprint and led workshop with stakeholders across the organization, from the onboarding team, sales team to middle office implementation team. I was able to break the silos among the teams who were working towards the same goal of improving the current account opening experience.

This enabled constructive breakout sessions to identify opportunities and gaps in the experience and I was able to iterate on the design concept based on the outcome of the workshop.

The new experience

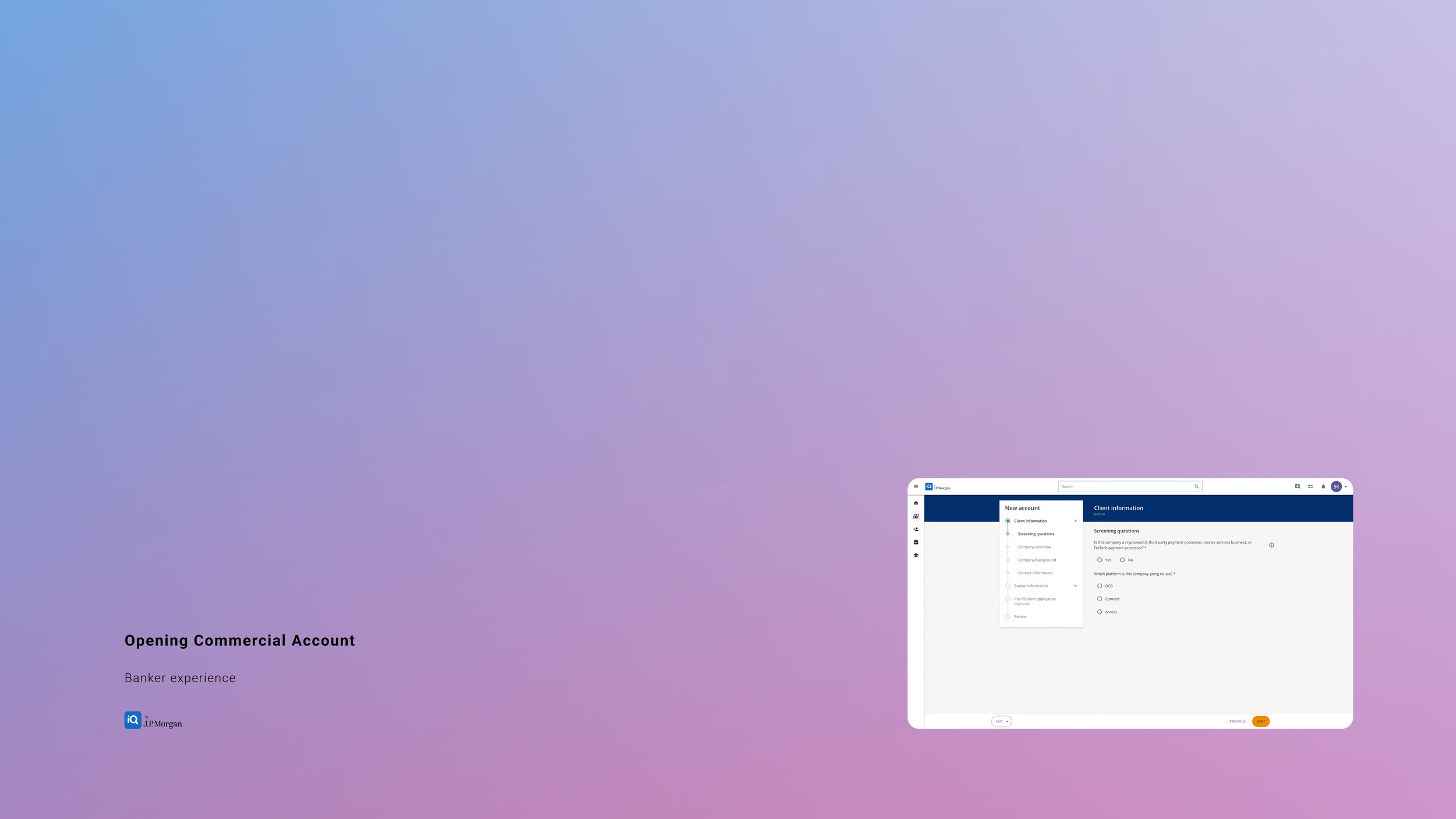

From the workshop, I was able to facilitate product roadmap alignment across the organizations and designed a new experience that reduce the amount of tools that a banker need to use into one.

Working along with other designers on the new banker platform, I led the design of standardizing banker initiated experience like account opening.

Banker can access client information and initiate onboarding from one place.

Banker can preview client application and pre-fill it for them if they have client information.

Banker can review the application information upon completion.

Banker will be able to access this guided account opening experience and check off client basic screening question. Information chunking with wizard flow makes it easier for a banker to focus on each part of the process.

Client and banker will have access to the same application. If client had any question about it, a banker can assist them throughout the process.

In many interviews we heard that client always complains about the process being not transparent enough, banker now can track the application status and share this with client.

Outcome

This design is currently in production with 120+ bankers using the platform, here are some banker feedback that we heard back on this account opening experience.

“This is amazing, it’s so quick and easy to submit”

“I love the ability to track cases after submission, the visibility is super helpful for me in managing client expectations”

Takeaway

Challenging established processes can lead to significant improvements. In light of the SVB bank run in March 2024, a revamped digital onboarding experience was introduced for new clients, reducing the account opening time from 2-3 weeks to just 1 day.

Utilizing design artifacts can facilitate strategic discussions and enhance collaboration among various teams within the organization. While these teams often strive toward common objectives, they may lack a comprehensive understanding of their interconnections across the bank. The service blueprint effectively identified existing capabilities and gaps among the teams, fostering unity and alignment in this initiative.